4 Types of Construction Compensation: Lump Sums, Unit Prices, Time & Materials, and Actual Costs [Gaille Energy Blog Issue 93]

- Posted by scottgaille

- On September 7, 2020

- 0 Comments

This article explains the differences between the four types of compensation typically used in energy construction agreements:

- Lump Sums. The contractor is paid a flat price for successful completion of all of the work. For example, a contractor might be paid a lump sum of $10,000,000 for the entire project. No matter what the contractor actually spends, it will only be paid $10,000,000. Thus, the contractor makes money if it actually spends $10,000,000 or less and potentially loses money if it spends more than $10,000,000.

- Unit Prices (Item-Based Rates). The contractor is paid a flat price for successful completion of work items. Each unit price is all-inclusive and embodies all costs, overhead, and profit for completing the specific work item. For example, a contractor might be paid a unit price of $1,000,000 per mile of installed pipeline. No matter what the contractor actually spends per mile of pipeline, it will only be paid $1,000,000 per mile. Thus, the contractor makes money if it actually spends $1,000,000 or less per mile and potentially loses money if it spends more than $1,000,000 per mile.

- Time & Materials (Time-Based Rates). The contractor is paid time-based rates (established by a rate sheet) for personnel and equipment on an hourly, daily, weekly, or monthly basis. Each rate is all-inclusive and embodies all costs, overhead, and profit for deploying a given person or piece of equipment to the project (for the applicable period of time). For example, a contractor might charge $1,150 for a repair crew, of which $1,000 represents the cost of the personnel, truck, and equipment and $150 is the contractor’s profit and overhead. Subject to other contract controls (such as good industry practices), a contractor doing work on a time & materials basis always recovers its costs and always makes a profit. Every hour worked is an hour paid.

- Actual Costs (Cost-Plus or Cost Reimbursable). The contractor is reimbursed its actual and reasonable out-of-pocket costs for the project plus a fee. The fee includes all of the contractor’s profit and overhead and can either be a fixed number (that does not vary based on the amount actually spent) or a percentage of the actual costs incurred. For example, the parties might expect to spend $100,000,000 on a project. The contractor could either negotiate a fixed fee of $15,000,000 or agree to charge 15% of whatever the actual costs may be. Subject to other contract controls (such as good industry practices), a contractor doing work on an actual cost basis always recovers its costs; how much profit it recovers is a function of whether or not the fee is fixed or calculated on a percentage basis. If the fee is a percentage basis, the outcome is similar to time & materials. The contractor always makes a profit because every dollar of actual costs spent results in a percentage fee being paid. However, if the fee is fixed, the contractor will make a higher profit percentage if it spends less than expected and a lower profit percentage if it spends more than expected. The below figures illustrate how the fee earned by the contractor varies between the percentage and fixed options:

Project owners must balance the advantages and disadvantages of the four types of compensation. While lump sums place the risk of cost overruns on the contractor, the contractor will usually demand a higher price for accepting this risk. The more risks a project faces, the more contingency a contractor will add to the lump sum. Such contingency can result in the lump sum being much higher than the estimated cost at completion on an actual cost basis. In such cases, owners can achieve cost savings by switching to one of the other compensation mechanisms. If the cost uncertainty is a result of how many units will be required, then a unit price mechanism may be best. If the cost certainty is more generalized, the actual cost with fixed fee approach may be the most efficient mechanism.

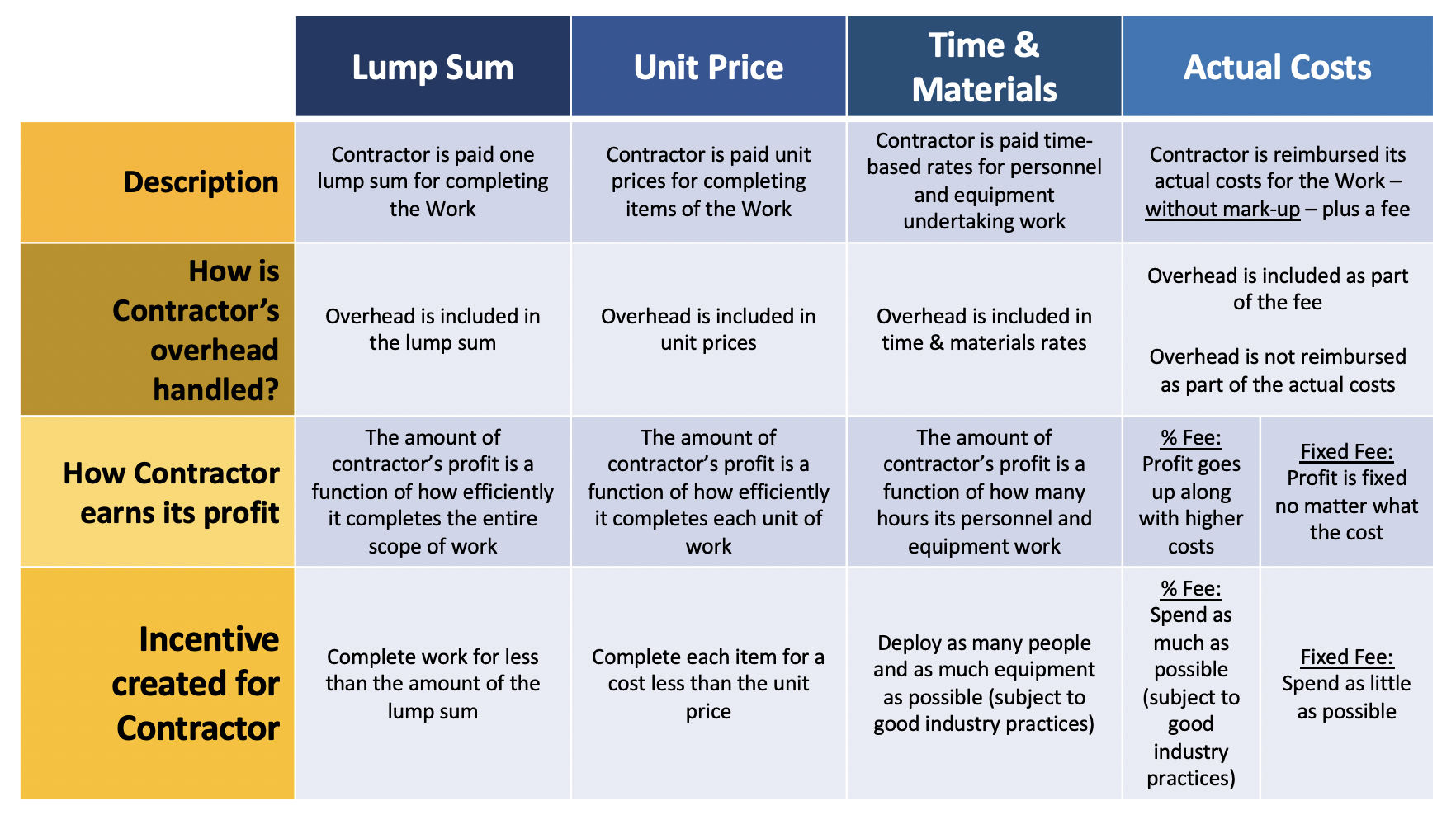

The below table summarizes the four principal types of contractor compensation and the incentives created by them:

It also is important to consider how “price adjustments” may affect the allocation of risks in any of the above types of compensation. Price adjustment clauses provide the contractor with additional compensation when a specified event causes increased costs. For example, if the contractor encounters an unanticipated site condition, a price adjustment may increase the lump sum payable to contractor (in a lump sum agreement) or increase the amount of the contractor’s fixed fee (in an actual cost with fixed fee agreement). See Adjustment Clauses in Services and Construction Agreements [Gaille Energy Blog Issue 92]. The key point for designing compensation mechanisms is that price adjustments are another tool the parties can use to manage the risk of cost overruns. For example, if the contractor is inflating a lump sum due to the risk of bad weather, then the solution may be keeping the lump sum structure, reducing the amount of the lump sum, and providing a price adjustment for adverse weather days (instead of, for example, switching to an actual cost approach).

Another option for addressing risk is the use of more than one type of compensation within the same construction agreement. If only a portion of a project is subject to cost uncertainty, it can be compensated differently. For example, consider a horizontal directional drill with a high variability of cost. The contract could provide that all of the project is compensated on a lump sum except for the problematic HDD, which would be compensated on an actual cost with fixed fee basis. Similarly, under actual cost agreements, certain discrete portions of the work may be paid for on a lump sum basis (such as mobilization and demobilization) because their costs are more certain.

In any event, it is critical that the construction agreement accurately define both the different types of compensation being used and which portions of the contractor’s work are compensated by each methodology. People often use the same word or words to describe different types of compensation mechanisms. Some people use the words “cost reimbursable” to refer to time & materials – while others use them to refer to actual cost basis. “Rate-based” may refer to time & materials rates or unit prices. The best way to avoid confusion (and disputes) is to ensure that the construction contract clearly defines each type of compensation being used and what work will get paid by it.

In our next post, we will examine how the above types of compensation structures can be supplemented with additional controls/incentives, such as not-to-exceed amounts, guaranteed maximum prices, and formulaic (cost-based or schedule based) adjustments to the actual cost fee.

About the Gaille Energy Blog. The Gaille Energy Blog (view counter = 162,119) discusses issues in the field of energy law, with periodic posts at www.gaillelaw.com. Scott Gaille is a Lecturer in Law at the University of Chicago Law School, an Adjunct Professor in Management at Rice University’s Graduate School of Business, the author of three books on energy law (Construction Energy Development, Shale Energy Development, and International Energy Development), and co-author of the award-winning travel compilation, Strange Tales of World Travel (Bronze Medalist, IPPY Awards for Best 2019 Travel Essay; ForeWord Magazine Finalist for Best Travel Book of 2019; North American Travel Journalists’ Honorable Mention for Best Travel Book of 2019).

Images available on the Internet and included in accordance with Title 17 U.S.C. Section 107.

0 Comments