Pipeline Crossings of Underground Obstructions [Gaille Energy Blog Issue 74]

- Posted by scottgaille

- On September 10, 2018

- 0 Comments

- pipeline crossing installations

More than 2.5 million miles of pipeline move American oil and gas production to refineries and consumers. The U.S. Energy Information Administration is tracking an additional $100 billion of new natural gas projects, which would add more than 10,000 miles to the existing network.

Pipeline construction requires a trench deep enough so that the top of the pipeline is buried ~3-4 feet below the surface.

New pipeline trenches necessarily encounter many preexisting buried utilities, including other oil and gas pipelines; water, irrigation, and sewage pipes; television cables; and fiber optic telecommunication lines. Each of these obstacles must be navigated by the contractor, driving up the cost of construction.

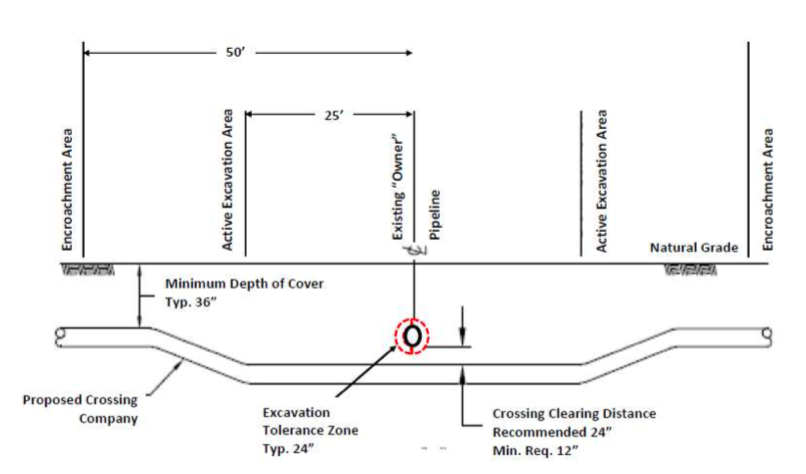

For example, the depth of a new pipeline may need to be lowered further so that it safely passes beneath an existing one. The below figure from the Interstate Natural Gas Association of America illustrates how one pipeline can be constructed beneath another.

The lowering of the pipeline requires additional work and cost, including tie-in welding that would not have been required in the absence of the foreign line. While a contractor may be able to obtain a list of line locations from public databases, these are often incomplete. How can the parties manage the risk that the contractor will encounter unknown (and unpriced) foreign lines during the new pipeline’s construction?

- Unit Pricing for Crossings of Underground Obstructions

The construction agreement can establish a pre-negotiated (unit) price for each unanticipated obstruction. For example, the contractor may be paid a flat fee of “$30,000 for each unknown buried utility crossing.” One issue with unit prices for line crossings is that the cost incurred by the contractor varies from crossing to crossing, potentially leaving one of the parties with a windfall.

Another issue is how should crossings be counted? In the figure below, there are three foreign pipelines clustered together.

Construction of the same installation is required for either one or three foreign lines—because once the pipeline has been lowered for the first foreign line, the other two are incidentally bypassed. Should the contractor get paid for one utility crossing ($30,000) or three utility crossings ($90,000)?

The answer depends on whether the word crossing is used in its ordinary meaning (crossing the street) or in its specialized, industry meaning (a crossing installation). In the natural gas industry, the term “crossing” refers to the constructed facility that lowers the elevation of the pipeline so it can pass beneath a foreign line. While three buried utilities are being crossed in the ordinary meaning of the word, there is only one crossing facility that needs to be constructed to pass beneath all three. Which interpretation prevails may depend on whether the agreement includes the convention of technical interpretation:

“Words having well-known technical or natural gas or petroleum pipeline industry meanings are used in this Agreement in accordance with such recognized meanings.”

The above example also highlights why unit pricing provisions for utility crossings should include additional language to clarify that the contractor is being paid for constructing a particular kind of facility—rather than how many foreign lines they come across:

“Underground Obstruction” means one or more submerged or buried structure(s) in the ROW that require(s): (a) the use of tie-ins to install the pipeline in order to avoid the obstruction(s) and (b) the lowering of the pipeline below the obstruction(s) to obtain the separation required by the Specifications. For purposes of clarity, if multiple obstructions are bypassed through a lowering of the pipeline, then the group of obstructions shall constitute only one (1) Underground Obstruction.

The above language forecloses the possibility that a clever contractor might argue that it should be paid $30,000 for each foreign line the pipeline happens to pass beneath, thereby giving it a windfall of 2X, 3X, or more of its actual costs.

- Actual Costs of Obstructions

Alternatively, the contractor can be paid its actual, incremental costs for encountering unknown obstructions. For example, the owner may have agreed to pay the contractor a lump sum of $500 million to build the pipeline. An exhibit to their agreement lists each of the known pipeline crossings that are included in the $500 million lump sum price.

The agreement then provides an adjustment mechanism by which the contractor can seek increases to the lump sum for unknown obstructions. When the contractor encounters an unknown utility, it can seek a price adjustment to the lump sum equal to the incremental cost of crossing it. Such an approach avoids some of the issues encountered with unit pricing, such as how to count crossings and whether actual costs will be more or less than the unit price.

The principal risks for the owner of utilizing actual costs are that the contractor might: (i) shift costs from the lump sum work to the crossing work or (ii) incur higher than expected costs for crossings (since the price cap of the lump sum has been removed in those cases). One way for the owner to mitigate these concerns is by limiting the contractor’s reimbursement to costs incurred in accordance with good industry practices:

“Good Industry Practices” means the actions, practices, methods, techniques, and standards that:

(a) are generally accepted by that segment of the United States pipeline industry operating pipeline facilities similar to those operated by the Owner;

(b) should be adopted by a party exercising that degree of knowledge, skill, diligence, prudence, foresight, and use of funding that would reasonably and ordinarily be expected from qualified, skilled, and experienced professional contractors specializing in the performance of work similar to the work required by this Agreement; and

(c) conform to this Agreement and applicable laws, codes, and standards.

The use of “good industry practices” to limit the contractor’s reimbursement of its actual costs provides the owner with a control by which it can refuse to reimburse costs for a botched or inefficient crossing installation.

While unanticipated crossings can be compensated through unit prices or actual costs, both approaches require specialized controls to ensure the contractor is neither penalized nor rewarded for encountering unknown obstructions.

About the Gaille Energy Blog. The Gaille Energy Blog (view counter = 78,834) discusses issues in the field of energy law, with periodic posts at www.gaillelaw.com. Scott Gaille is a Lecturer in Law at the University of Chicago Law School, an Adjunct Professor in Management at Rice University’s Graduate School of Business, and the author of three books on energy law (Construction Energy Development, Shale Energy Development,and International Energy Development).

Images available on the Internet and included in accordance with Title 17 U.S.C. Section 107.

0 Comments